In this article, we’ll get into the “nitty gritty.” We‘ll begin our discussion of the “levers” (the things that give you financial leverage) you can pull to increase your future net worth (or wealth if you prefer that term; most Christians don’t care for it, but as I noted in an earlier article, it shows up quite often as “riches” in the Bible.)

Unfortunately, you can’t literally pull this lever on day zero; your net worth (Wt ) starting out “is what it is.” In that respect, it’s not a lever at all.

That phrase, “it is what it is,” sounds like resignation, capitulation to a situation that isn’t going to change.

But you know what? For most of you, while “it is what it is,” we can add “for now.” You can change it (hopefully increasing it, rather than decreasing it). And even if it goes in a different direction for some unexpected reason, it won’t be forever—God works, and He can change things as we patiently cooperate with Him and His sovereign will.

God is sovereign over all things, including our lives and finances. That means things may not always be as we want them to be, but we trust God that things are as He has ordained them for our good. Romans 8:28 says, “And we know that for those who love God all things work together for good, for those who are called according to his purpose.” (ESV)

So, we accept our current situation as coming from God, who is good, gracious, and all-wise. However, we also do what we can to improve it wisely. It’s not either-or but both-and. See Psalms 145:8-17 to understand how God is predisposed to draw near and care for His children.

Here's our pesky "financial life equation" (FLE) again. Note how the "current wealth" variable (Wt) fits. (Remember, I’m using the Greek sigma Σ symbol for “the sum of” and t+n = t+n years, with n signifying a "variable number of years.”)

Wt+n = Wt + ∑It+n –∑Tt+n–∑Gt+n–∑Et+n+ ∑IEt+n–∑IPt+n

To refresh your memory, the simple translation is: Future Wealth (Wt+n) is current Wealth (Wt) plus the sum of your income over the next N years (∑It+n) minus the sum of your taxes over the next N years (∑Tt+n ) minus the sum of all your giving over ten next N years (∑Gt+n) minus the sum of your living expenses over the next N years (∑Et+n) plus the sum of your interest earned over the next N years (∑IEt+n) minus the sum of your interest paid over the next N years (∑IPt+n).

Remember, the whole point of this equation is to illustrate the critical mathematical relationships between income and expenses and how they affect total wealth over a lifetime.

I’m trying to make a point: Current wealth certainly factors in, but since we don’t necessarily have much control over it, the other variables matter the most. While it usually helps to start with more in the present to have a higher net worth in the future, that is not always the case. Some people may start with a large inheritance and squander it early.

However, most young people leave school with low, zero, or negative starting wealth. If that's you, you can probably see how the FLE hasn’t worked for you yet. But as I said in the title, don’t sweat it. You’re just starting! Yes, you may have had low earnings, consumed a lot, earned little interest, or paid a lot of interest (mostly on student loans), but that will change. I can almost guarantee it unless you go off the rails for some reason.

I also know that some may have very different backgrounds than others, challenging circumstances that have hindered their ability to build wealth early in life or to avoid “negative” wealth.

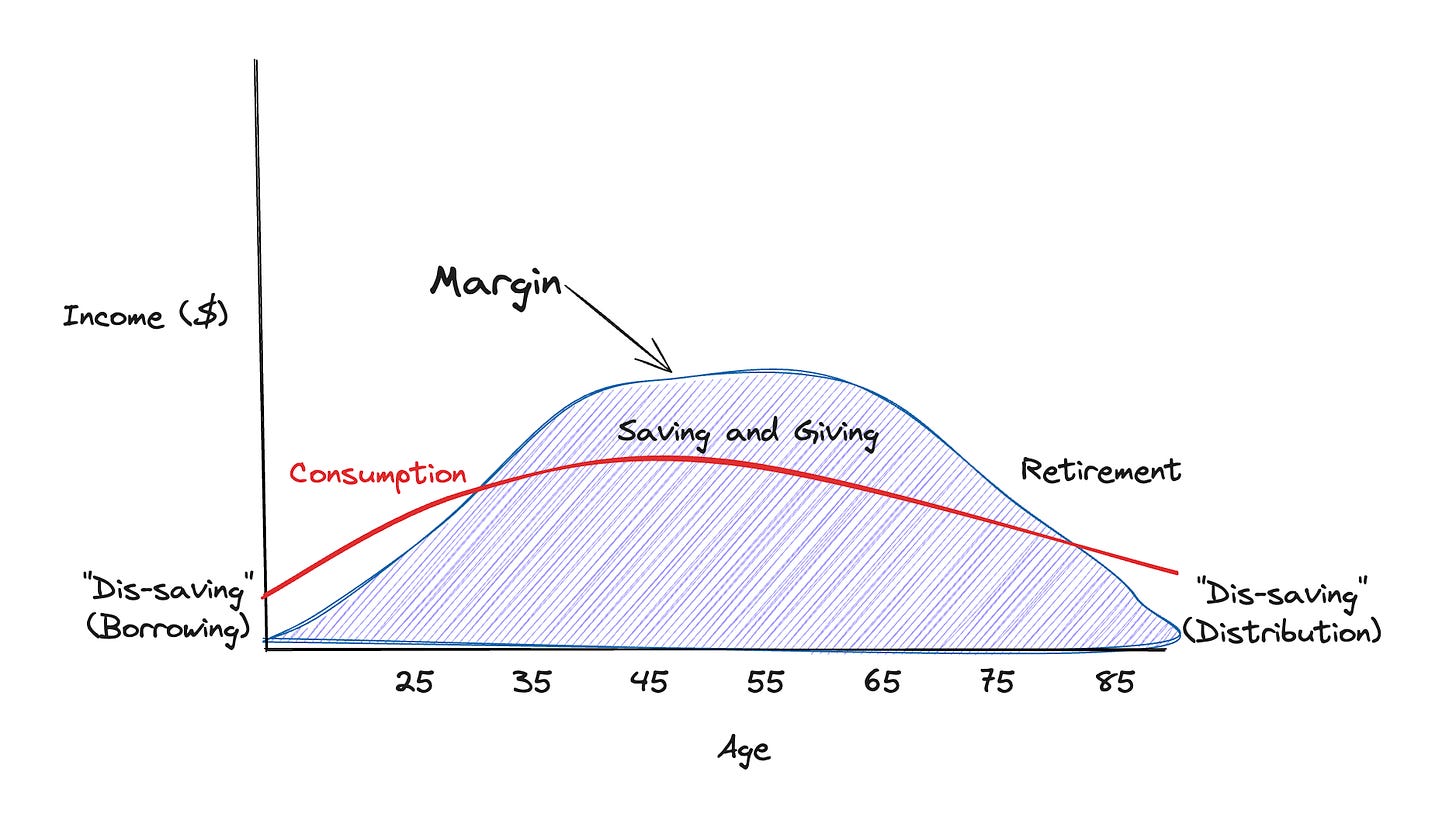

The same applies to you: your situation can change! Many young adults will see their financial condition improve dramatically as they move from dependence (on family and student loans) and “dis-saving” to independence, generating an income, saving, and giving, thus creating that “margin” I’ve been talking about.

On the other hand, if your net worth is positive starting out (which is unique), that is good for you, but you could still mess it up. Unless you are a “trust baby,” the equation relationships suggest that you’ve been in the workplace for a while, that you've been earning a little more each year (hopefully enough to keep up with inflation, which can be tricky), paid relatively low taxes, kept your spending in check, earned some interest (more with higher rates lately), paid very little interest (on loans or credit cards) and perhaps done some investing in an IRA and maybe even purchased a home and built up some equity (more on that later in the article).

Hopefully, you've also been giving generously. If so, you're off to a good start a few years out of high school or college. It's more likely that you're doing some combination of these, and they're also possibly canceling each other out; for example, interest paid negates interest earned. Your home's value may have increased, but the mortgage cancels out most of its value and leaves you with limited equity. (That situation improves as you pay off your mortgage principal.)

The key message is to take responsibility for your financial condition, no matter your past or present circumstances, while trusting God, your Provider, who cares for you. I want you to know that, regardless of your situation, it can change. How? It doesn’t mean that all obstacles and headwinds will disappear. You still need to do your part to fight the good fight in all areas of your life, but because God cares for you, including your finances, you can pray and trust God to do His part.

And remember, as I've said before, you can't depend on your family, employer, friends, or the government to do this for you. It’s you and your Heavenly Father (with help from great resources like this, haha.)

You also may need a different perspective. A few years ago, I read an excellent book on Ecclesiastes titled "Living Life Backward: How Ecclesiastes Teaches Us to Live" ( I highly recommend it). The idea behind the title is that we need to think about our future selves, both in terms of our finite time on this earth and our eternal selves in the new heavens and new earth, and live our lives to the fullest today as we anticipate those days.

I don't mean to sound morbid, and I know this isn't a topic that 20- or 30-somethings usually discuss. But we must accept the seasons of our lives as coming from God's good and wise hands and always remember that we will be older one day. (Trust me, that day seems to come sooner than we ever imagined.)

But I'll be the first to acknowledge a real battle here, especially when we're young. Academics refer to this as the psychological and emotional struggle between our "current self" and a more prudent, forward-thinking "future self." In some ways, our current self is the world, our flesh, and the devil telling us to do this or do that and to do it NOW, whereas our future self is godly wisdom speaking to us as a good angel concerned for our future well-being.

We fight this battle every day regarding what we eat, how we spend our money, whether we exercise, and so on. The current self is impulsive and short-sighted and typically wants to maximize pleasure RIGHT NOW. The future self says, “No, stop, think about it.” It aims to curb the current self's short-term impulsiveness and draw our attention to the future self's long-term goals.

In some ways, that's also what NextGenSteward is about: encouraging and helping you think about your present, future, and eternal self and make wise financial decisions until your eternal self doesn't have to worry about it anymore. For a more extensive treatment of this whole idea of space and time and the Christians' relationship to it, check out my article "Space, Time, and Retirees" on retirementstewardship.com.

For reflection: How often do you think of your “future self”? What would your future self say to your current self about how you manage your finances? Listen to your future self.

Verse: “In the house of the wise are stores of choice food and oil, but a foolish man devours all he has” (Proverbs 21:20, ESV).