I like broccoli, but I also want health insurance. You may not like broccoli, but you, too, need some health insurance.

Since I am a “retiree,” I go through the annual Medicare “enrollment period.” And I will confess, it sometimes makes me a little crazy. Not because I have to re-enroll (although I can change policies in some cases), but because of all the misleading commercials on TV, online, and in the mail. (If you want to see what I’m talking about, check out this post on my retirement blog.)

(Don't worry; you won't have to think about it for a long time, but it has to do with all the different "parts" and plans of Medicare and the myriad decisions retirees must make when they turn 65.)

Health insurance is essential; another look at our “risk continuum” shows us why:

A significant health-related event is a relatively high risk, similar to the loss of life. A high-cost medical “event” is a low probability (especially for young people), but it can devastate your finances without insurance.

You may already know that someone age 26 and younger can get on or stay on a parent's healthcare plan. That’s a good thing, but remember, your goal is to become less dependent on your parents, so make it your goal to get your own coverage when you can. (You’ll have to when you turn 27.)

If someone claims you as a tax dependent, you can buy insurance on the Affordable Care Act (ACA) Marketplace, but you won't qualify for savings based on your income.

As a young adult, even if you're under age 26 but work for a company that offers health insurance (lucky you), you, too, have an annual “benefits enrollment period." It's usually toward the end of the year and includes all your employer benefits, not just health care.

You may be familiar with this, but if not, here are some important healthcare insurance terms and definitions that will help you work through the process:

Health insurance PREMIUMS are the monthly costs of purchasing healthcare insurance. Chances are good that your employer is subsidizing some of it. If you want to know how much, ask them or check your monthly paystub—it will tell you who pays what.

Many people underestimate the actual cost of health insurance because they don’t know how much their employer contributes; it’s probably more than you think.

These premiums come right off the top of your pay, but the good news is that, in most cases, they are not subject to federal or state income taxes. Therefore, your taxable income is already lower.

That makes insurance less expensive for high-income employees because they are in a higher marginal tax bracket and save more in taxes. (And if you're wondering, the poor who can't afford any insurance are pretty well taken care of in our country; they get decent healthcare for free through Medicaid.)

You must pay 100% of the healthcare expenses before reaching your DEDUCTIBLE. They can be paid for with cash (after-tax), FSAs, or HSAs (pre-federal, pre-state, and pre-social security taxes—more on them later). Your insurance kicks in after you reach your deductible, and the insurance company starts paying for stuff. How much depends on your company and plan.

After you reach your deductible, COINSURANCE is the percentage of the additional costs you are responsible for. Typically, coinsurance can range from 10% to 30% or more, so your insurance company is on the hook for the remaining 70% to 90%. If you wish, these expenses can be paid from your FSA or HSA, just as your deductible can.

After the deductible is met, your OUT OF POCKET MAXIMUM is the maximum amount you must pay. If your deductible is $5,000 and your maximum is $7,500 (without the deductible) or $12,500 (with the deductible), the most you can be responsible for is $12,500 (= $5,000 + $7,500).

If you have a high-deductible healthcare plan (HDHP), your employer may offer a HEALTH SAVINGS ACCOUNT (HSA) to allow you to save for medical expenses. For 2025, a HDHP is defined by the IRS as "a health plan with an annual deductible that is not less than $1,650 for self-only coverage or $3,300 for family coverage, and for which the annual out-of-pocket expenses (deductibles, co-payments, and other amounts, but not premiums) do not exceed $8,300 for self-only coverage or $16,600 for family coverage."

The annual contribution limit to an HSA in 2025 is $4,300 for a single and $8,550 for a family. These contributions can be invested in stocks and bonds. Unused HSA funds carry over from year to year. You can fund it with pre-tax money like a Traditional 401(k), but unlike a Traditional 401(k), you don’t have to pay Social Security or Medicare taxes on these contributions. In that way, it can function like a" shadow” retirement account.

A FLEXIBLE SAVINGS ACCOUNT (FSA) is a savings vehicle you can utilize if your employer offers it, even if you don't have an HDHP. The annual contribution limit for 2025 is $3,300 ($6,600 for couples if both have a plan). The FSA can't be invested, but for those that permit the carryover of unused amounts, the maximum carryover to 2025 is $660. Any unused funds over that amount are forfeited. (Better run out and buy those Band-Aids after Christmas!) For FSAs that permit the carryover of unused amounts, the maximum carryover amount for 2025 is $660.

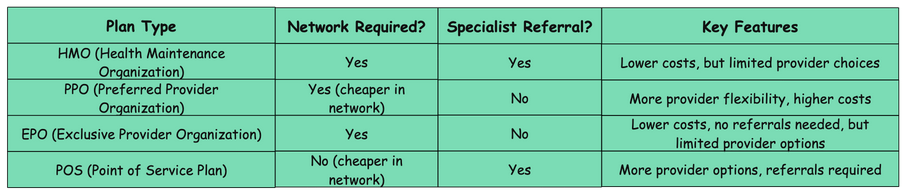

There are several types of health insurance plans, each with different coverage options, restrictions, and costs.

“Network required” refers to the list of approved physicians in the company’s “network.” “Specialist referral” means that a referral by a primary care physician is required for a specialist physician visit to be covered.

Most employers have online tools available to help you choose the right plan for you based on several factors:

The actual plan choices through your employer (high, medium, or low deductible or HDHP)

The plan provisions (premiums, deductible amounts, coinsurance percentages, out-of-pocket maximum, total out-of-pocket maximum)

Your tax situation (federal marginal tax rate, state marginal tax rate, Medicare marginal tax rate, Social Security marginal tax rate)

You can ignore the income tax implications of the decision and just start with your annual premiums. (You must pay them even if you have no medical expenses.)

Once you have a healthcare expense, you must pay it out of pocket up to your deductible. As you continue to incur more expenses, your out-of-pocket expenses increase until you reach the maximum. At that point, you're no longer responsible for any additional covered medical expenses during that year.

This illustrates a peculiar aspect of how this works. Until you hit the deductible, you bear 100% of the cost. Once you hit the deductible, you’re responsible for the coinsurance. Once you hit the out-of-pocket maximum, you’re responsible for 0%.

As a result, people start doing weird things when the price of something becomes zero. Suddenly, you're more apt to go to the ER for a headache or sore throat. (Okay, I'm kidding, but it could happen.)

You might also consider the tax implications of your choice. You'll have to do some math (sorry, you were forewarned, LOL). (We haven't discussed taxes in detail yet—that’s coming in the next series of articles—but your "marginal rate" is the percentage of tax you owe for your last dollar of income, meaning it reflects the rate at which your next dollar earned will be taxed.)

Health insurance premiums reduce your tax liability by:

Your Annual Premium x (Federal Marginal rate + State Marginal Rate)

For example, let’s use the following assumptions:

Federal Marginal Tax Rate: 22.00% <=== will be 12% or 22% for most of us

State Marginal Tax Rate: 5.00% <=== will be 4.5% for NC (other states may be higher or lower)

Annual healthcare insurance premium: $3,960 <=== estimate based on the average cost of AFCA "silver" plan with 50% employer subsidy (your company's subsidy could be considerably higher or lower)

The calculation for someone with a gross salary of $80,000 would be as follows:

This effectively reduces your premiums by ($3,960 – $1,049) = $2,911.

Contributions to an FSA / HSA shift the effective premium costs down further based on the following formula, because they are before Social Security and Medicare withholding:

Your FSA/HSA Contribution Amount x (Federal Marginal Rate + State Marginal Rate + Social Security Marginal Rate + Medicare Marginal Rate)

Assumptions:

Medicare Marginal Tax Rate: 1.45% <=== will be 1.45% for most

Social Security Marginal Tax Rate: 6.20% <=== will be 6.20% for most

You can do the calculation if you’re in this category.

The next thing you need to do is estimate how much you're likely to spend in the next calendar year. (We all know a major medical "event" can change things, so running a "what if" scenario would be wise.) Then, you can run the calculations and choose the plan with the lowest after-tax cost, given your expected healthcare expenses, considering the other plan provisions.

Assumptions (based on ACA Silver Plan in NC):

$2,911/yr after tax in premiums (from the above example)

$1,575 deductible

50% coinsurance

$9,200 out-of-pocket maximum

$5,000 estimated cost of medical service(s)

Then, use these steps to estimate your total out-of-pocket cost for healthcare:

Compare the cost of service to the deductible ($5,000 > $1,575 deductible)

Calculate the cost of services minus the deductible (or zero if it's negative) ($5,000 – $1,575 = $3,425)

Multiple #2 by the coinsurance percent (.50) ($3,425 x .50 = $1,713)

Take the lesser of #3 or the out-of-pocket max of ($1,713 < $9,200)

Add annual after-tax premium costs ($2,911)

Based on a $5,000 service cost, your total cost for the year would be ($1,713 + $2,911 = $4,624). In this example, a higher deductible or lower coinsurance percentage would have reduced your total expense.

That gives you a basic idea of how much any set of services for a year will cost you in real out-of-pocket money. Plus, you can see how things change if you have a significant medical expense. You would pay no more than ($2,911 +$9,300 = $12,211), even if the service cost was hundreds of thousands of dollars. That’s the real advantage of health insurance!

That said, $12,211 is nontrivial, but the premium of $2,911 is a sunk cost, so you’ll need to come up with the $9,300 or pay it back in installments. An emergency fund can help with that, or you could sign up for a lower out-of-pocket maximum, increasing your premium payments—choose wisely.

The ACA premium subsidy “cliff: is back. Many people get their healthcare through healthcare.gov or their state exchange instead of through an employer-sponsored plan. But in 2025, the “One Big Beautiful Bill Act” (OBBBA) didn’t extend the temporary ACA subsidy enhancements from the COVID era. So, starting in 2026, the infamous Premium Subsidy Cliff returns.

That means if your income is even $1 over 400% of the Federal Poverty Level (FPL) (e.g., $84,600 for a couple), your premium tax credit drops to zero, instantly raising your annual health insurance cost by thousands. For example, a couple earning $85,000 could lose a $13,000 subsidy overnight!

Here are the thresholds by household and income:

Source: Federal Poverty Levels (FPL) For the Affordable Care Act.

If you buy health insurance through the ACA marketplace and are near that income threshold, it’s crucial to project your Modified Adjusted Gross Income (MAGI) and manage it carefully. Use pre-tax retirement contributions, avoid unnecessary capital gains, or defer income to stay under the line.

Starting in 2026, all Bronze ACA plans will be HSA-eligible, and the repayment cap is eliminated, so estimating your income correctly matters more than ever. Smart planning now can help you avoid costly surprises later.

For Reflection: The Bible states that for Christians, our bodies are temples where the Holy Spirit dwells. Ponder that one for a second: The Spirit of God, the Third Person of the Trinity, lives in us. I’m unsure how exactly—it’s a mystical union, but I know it’s true (Romans 8:9). What an amazing truth it is!

Compared to the rest of the world, we have excellent healthcare but inferior overall outcomes. We eat too much unhealthy food and too little nutritious food, and we move our bodies too little. So, take care of the one (mortal) body that God gave you, as no amount of healthcare spending can compensate for failure to do that. Wash your hands and eat your broccoli.

Verse: “Or do you not know that your body is a temple of the Holy Spirit within you, whom you have from God? You are not your own, for you were bought with a price. So glorify God in your body” (1 Corinthians 6:19–20, ESV).